What is 1099C? Guide to Debt Cancellation & Tax Impact

One important form you might encounter when dealing with debt cancellation is the

1099-C. But

what is 1099C exactly, and how does it impact your taxes?

This

complete guide is well-structured to provide all the necessary information about Form 1099-C, its meaning, and the tax implications of debt cancellation in the United States.

The first thing you need to understand

is that is a form issued by lenders when they cancel a debt of $600 or more. This form is necessary because the

Internal Revenue Service (IRS) considers canceled debt taxable income. Therefore, if you receive a

1099-C, you must report the amount as income on your tax return.

Continue reading to understand how to handle the 1099c form, report canceled debt and face the potential tax consequences effectively.

Keep reading!

Index

- Understanding Form 1099-C

- What is 1099-C Form?

- 1099-C Meaning

- Tax Implications of Debt Cancellation

- Taxes on Debt Settlement

- What Are the Tax Consequences of Debt Settlement?

- Does Debt Settlement Affect Your Taxes?

- Exceptions and Exclusions

- Insolvency Exclusion

- Bankruptcy Exclusion

- Other Exclusions

- How to Report Canceled Debt

- Filing Form 982

- Reporting on Your Tax Return

- Debt Cancellation in Florida

- Key Advice

- Additional Information on Form 1099-C

- Who Can File Form 1099-C?

- Common Reasons for Receiving a 1099-C

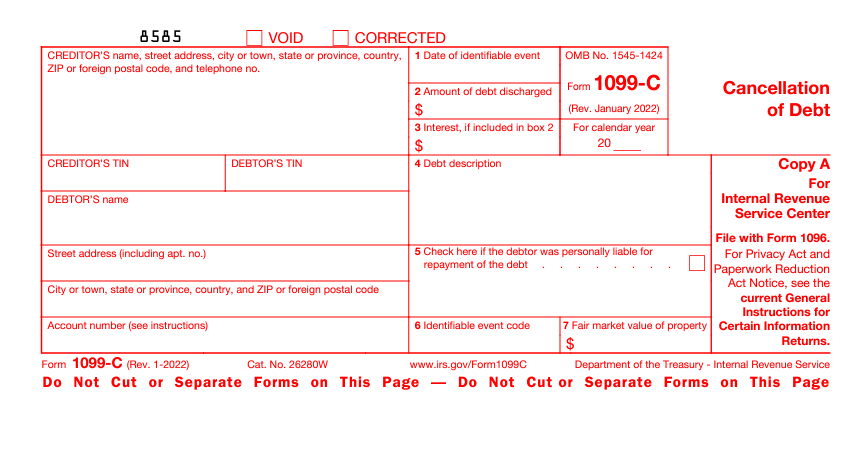

- What Information Is on Form 1099-C?

- How to File Form 1099-C

- FAQs on Cancellation of Debt Taxes

- Recommendations

1. Understanding Form 1099-C

1.1 What is 1099-C Form?

The 1099-C form is used to report the cancellation of debt. It includes details such as the amount of debt canceled, the date of cancellation, and the creditor’s information. This form is essential for both the

IRS and the taxpayer to ensure that all taxable income is reported correctly.

You can find the form 1099c here.

1.2 1099-C Meaning

If you receive a 1099c it signifies that a creditor has forgiven or canceled a portion of your debt. This cancellation is considered income, which means it can affect your tax liability.

2. Tax Implications of Debt Cancellation

2.1 Taxes on Debt Settlement

When a debt is settled for less than the amount owed, the forgiven portion is considered taxable income.

2.2 What Are the Tax Consequences of Debt Settlement?

The tax consequences of debt settlement can be substantial. If you settle a debt for less than what you owe, the forgiven amount is treated as income, which can increase your taxable income and potentially push you into a higher tax bracket.

For example, if you owe $10,000 on a credit card and negotiate with the creditor to settle the debt for $6,000, the creditor forgives the remaining $4,000. This forgiven amount of $4,000 is considered taxable income by the IRS.

If your annual income is $50,000, the forgiven debt increases your total taxable income to $54,000. Depending on your tax bracket, this additional income could push you into a higher tax bracket, resulting in a higher overall tax liability.

So, while settling the debt reduces what you owe, it can also lead to a higher tax bill because the forgiven amount is treated as income.

2.3 Does Debt Settlement Affect Your Taxes?

Yes, debt settlement can affect your taxes. As you read above, the forgiven debt is considered income, which means you may owe taxes on it. Understanding these implications is important to avoid any surprises when filing your tax return.

3. Exceptions and Exclusions

3.1 Insolvency Exclusion

If you were insolvent when the debt was canceled, you might not have to include the canceled debt in your taxable income. Insolvency means your liabilities exceed your assets.

3.2 Bankruptcy Exclusion

Debts discharged in bankruptcy are not considered taxable income. If your debt was canceled as part of a bankruptcy proceeding, you do not need to report it on your tax return.

3.3 Other Exclusions

There are other situations where canceled debt might not be taxable, such as certain student loans forgiven due to work in specific professions or debts canceled as a gift.

4. How to Report Canceled Debt

4.1 Filing Form 982

To exclude canceled debt from your taxable income, you must file Form 982 with your tax return. This form helps you adjust your tax basis in the property associated with the canceled debt.

You can find Form 982 here.

4.2 Reporting on Your Tax Return

When you receive a 1099-C, you must report the canceled debt as income on your tax return unless you qualify for an exclusion. Make sure to

consult with a tax professional to ensure you’re reporting everything correctly.

5. Debt Cancellation in Florida

In Florida, as in other states, the forgiven debt is treated as income, and you must report it on your federal tax return.

However, Florida does not have a state income tax, so you won’t need to report the forgiven debt on a state tax return.

Depending on your financial situation, you might qualify for the insolvency exclusion, reducing your taxable income.

Remember, always

consult with a tax professional to understand how these rules apply to your specific situation and to explore any potential exclusions or deductions that may apply to you.

Ask our Manare consultants for tailored debt relief solutions designed just for you.

6. Key Advice

- Keep Records: Always keep a copy of your 1099-C form and any related documents. This will help you accurately report your income and avoid any issues with the IRS.

- Consult a Professional: If you’re unsure about how to handle your canceled debt, consult a tax professional and also our debt relief consultants.

- Understand Exclusions: Familiarize yourself with the exclusions that might apply to your canceled debt. This can significantly reduce your taxable income and save you money.

- Plan Ahead: If you anticipate receiving a 1099-C, plan for the potential tax impact. Setting aside some extra funds can help you cover any additional tax liability.

7. Additional Information on Form 1099-C

7.1 Who Can File Form 1099-C?

There are three copies of the 1099-C. The lender must file Copy A with the IRS, send you Copy B, and retain Copy C.

If you borrowed money from a commercial lender and at least $600 of that debt was canceled or forgiven, you should receive Form 1099-C from the lender.

7.2 Common Reasons for Receiving a 1099-C

Lenders send 1099-C forms for various reasons, including:

- Foreclosure: When a lender takes possession of a property due to the borrower’s failure to make mortgage payments, the forgiven debt from the foreclosure is reported.

- Repossession: If a borrower defaults on a loan for a vehicle or other personal property, and the lender repossesses the item, the forgiven debt is included in the form.

- Return of Property to a Lender: When a borrower voluntarily returns property to the lender to settle a debt, the forgiven amount is documented.

- Abandonment of Property: If a borrower abandons property that was used as collateral for a loan, the lender may cancel the remaining debt and report it.

- Loan Modification on a Principal Residence: When a lender agrees to modify the terms of a mortgage, such as reducing the principal amount owed, the forgiven debt is recorded.

- Resolving a Credit Card Debt: If a borrower negotiates a settlement with a credit card company to pay less than the full amount owed, the forgiven debt is reported.

7.3 What Information Is on Form 1099-C?

The form includes details about the creditor and the borrower, such as names, addresses, tax identification numbers, and the associated account number. It also has seven boxes:

- Box 1: Date of identifiable event

- Box 2: Amount of debt discharged

- Box 3: Interest included in the debt

- Box 4: Description of the debt

- Box 5: Indicates if the debtor was personally liable for the debt

- Box 6: Identifiable event code

- Box 7: Fair market value of property (if applicable)

Click here to see the full 1099c Form.

7.4 How to File Form 1099-C

When you receive the form, report the amount from Box 1 on your income tax return on the “Other income” line of your Form 1040 or 1040-SR. Note that you must include the canceled debt in your income even if it’s less than $600 and you don’t receive Form 1099-C.

You do not need to submit Form 1099-C when you file your tax return, but you should hold onto it for your records.

8. FAQs on Cancellation of Debt Taxes:

How can I replace a lost 1099-C?

If you don’t receive a 1099-C but had debt canceled, you are still required to report the canceled debt as income on your tax return. Contact your creditor to request the form if you believe you should have received one and if you are aware of the precise amount of your forgiven debt, you can report it on your Form 1040.

What steps should I take if I forget to include a 1099-C on my taxes?

Contact the creditor who issued it to request a duplicate. You will need this form to accurately report your income.

What steps should I take if I forget to include a 1099-C on my taxes?

You may need to file an amended return. Consult with a tax professional to correct the oversight and avoid potential penalties. You should use Form 1040X.

Do I need to report canceled debt under $600?

Even if your canceled debt is less than $600 and you do not receive a 1099-C, you are still required to report it as income on your tax return.

How can I determine if my canceled debt is excluded from taxable income?

If you’re unsure whether your canceled debt qualifies for an exclusion, consult Form 982 and the IRS instructions here. A tax professional can also provide guidance.

What should I do if I receive a 1099-C for an old debt?

If you receive a 1099-C for an old debt, you are still required to report it as income for the tax year in which the debt was canceled. Verify the information with your creditor if you have any doubts.

How do I correct errors on my 1099-C form?

If your 1099-C form contains incorrect information, contact the creditor immediately to correct the errors. Ensure the corrected form is filed with the IRS and that you receive a copy.

9. Recommendations

If you know how to handle this form and the potential tax consequences, you can better manage your finances and avoid unexpected tax liabilities.

Always consult with your accountant or a tax professional because every case is different.

If you’re struggling with debt, consider seeking professional debt relief services from one of our Manare Debt Relief consultants in Florida.

Note: Feel free to share this guide with anyone who might benefit from understanding the tax implications of debt cancellation.

All Rights Reserved | Maranatha Debt Relief LLC